About the database

The database is suited for

- AI strategy/business case development

- Sector scan+Customer/vendor selection

- Competitive analysis

- Go-to-market/market entry strategy

- And more

The list is a structured repository of 530 generative AI projects

Database structure

| Column name | Description |

| Company | Name of the company that implemented the project. |

| Industry (ISIC classification) | Industry classification (ISIC code) of the customer |

| Project description | A brief description of the project |

| Country | Country that the project took place in |

| Region | Region that the project took place in |

| Vendor | Name of the vendor that has published the case study/project on their website |

| Year | Year that the project was implemented |

| Link | Unique identifier of each case study/project |

| Key department and activities that are improved by each project | Each project is grouped into one or more of the follogin departments: Sales, Marketing, Operations/mfg, Maintenance/field service, Finance and account, Human resources, IT/technology, Research and development, Customer service/support, Legal and compliance, Procurement, Logistics and supply chain, Corporate strategy/business development, Facility management. A project can touch mulitple departments. Each department is broken down into key activities. |

Companies mentioned

A selection of companies mentioned in the report.

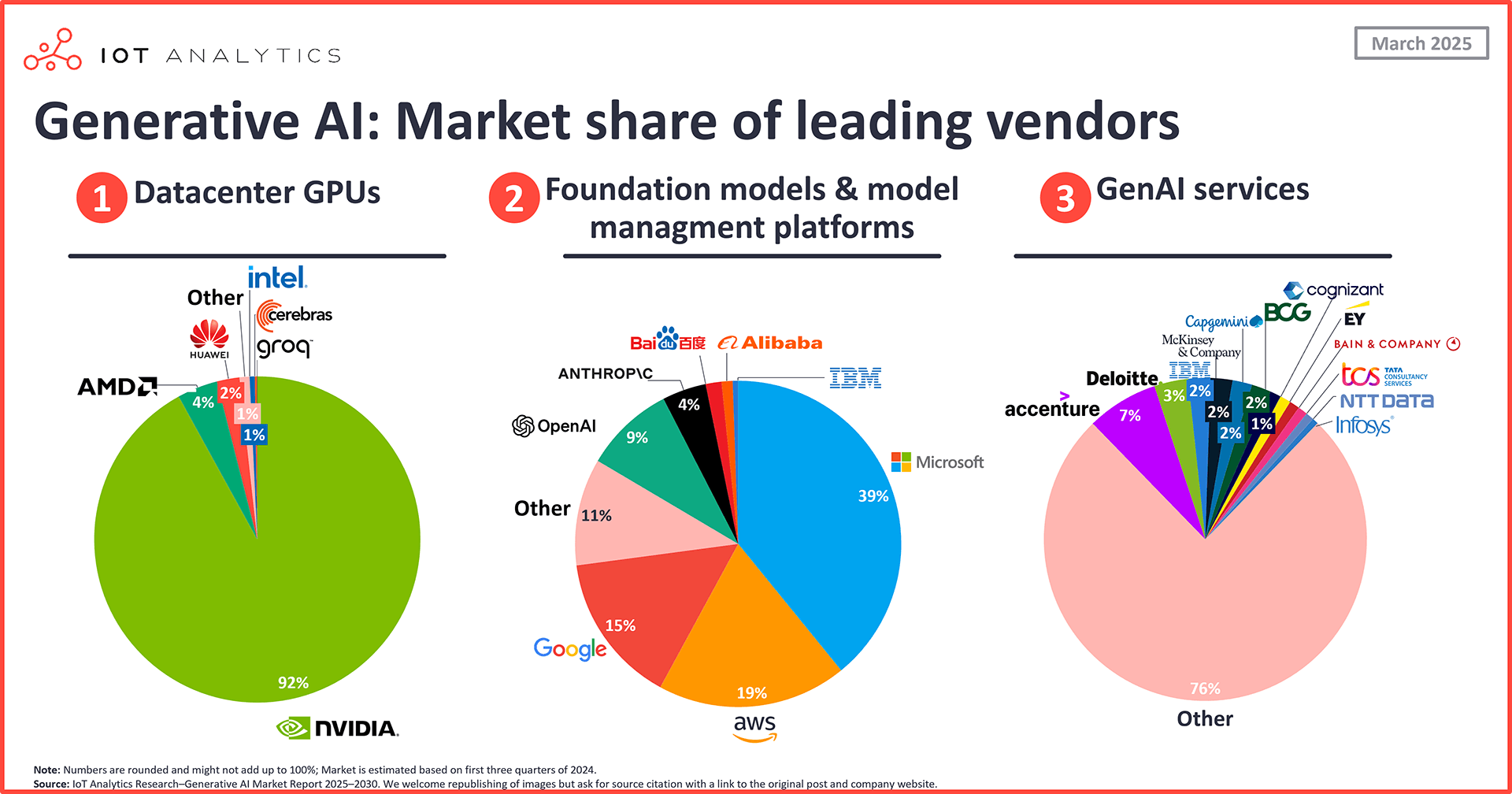

AMD AWS Accenture Alibaba Anthropic Baidu Capgemini Cerebras Cognizant Cohere Google Groq Huawei Hugging Face IBM Infosys Microsoft Nvidia OpenAI

Our insights are trusted by global industry leaders

The leading generative AI companies

The rise of generative AI: Rapid market growth and widespread adoption

Generative AI market surpassed $25 billion in 2024. Over two years, the combined generative AI software and services market (including foundation models and model management platforms) skyrocketed from a mere $191 million market in 2022 to $25.6 billion in 2024,* according to IoT Analytics’ 263-page Generative AI Market Report 2025–2030 (published January 2025). According to the analysis in the report, the acceleration of generative AI adoption across industries is driving this growth, with businesses increasingly incorporating AI-driven capabilities into their operations. Since the introduction of breakthrough Generative AI models, CEOs have increasingly discussed AI and its workplace applications in their earnings calls, and companies have raced to leverage this technology.

*Note : The combined market size for generative AI foundation models, model management platforms, and services does not include the market for individual generative AI applications (such as ChatGPT).

Key adopter quote

“We’re finding tangible ways to leverage GenAI to improve the customer, member, and associate experience. We’re leveraging data and LLMs from others and building our own.”

Doug McMillon, CEO of Walmart (during Walmart’s Q2 2025 earnings call on August 15, 2024)

The AI hardware market—specifically, data center GPUs—also experienced vast growth, climbing from $17 billion in 2022 to $125 billion in 2024 as major hyperscalers and large IT software companies (most notably, Salesforce and Meta) raced to expand their cloud and AI capabilities using the powerful processors.

About IoT Analytics’ generative AI market coverage

Insights in this article are from IoT Analytics’ 263-page Generative AI Market Report 2025–2030, its 3rd report about generative AI in general and its 2nd major market report on the topic.

While traditionally focused on the intersection of industry and technology, IoT Analytics has covered the AI markets since 2017, starting with industrial AI and predictive maintenance applications. Over the years, it expanded its scope to broader technology and enterprise trends, including (generative) AI, given its far-reaching impact across industries.

- For generative AI end users: Understanding who is ahead, who is upcoming, and the strengths and weaknesses of individual players and their models is important when building generative AI solutions and making important vendor and architecture decisions.

The rise of generative AI: Rapid market growth and widespread adoption

Generative AI market surpassed $25 billion in 2024. Over two years, the combined generative AI software and services market (including foundation models and model management platforms) skyrocketed from a mere $191 million market in 2022 to $25.6 billion in 2024,* according to IoT Analytics’ 263-page Generative AI Market Report 2025–2030 (published January 2025). According to the analysis in the report, the acceleration of generative AI adoption across industries is driving this growth, with businesses increasingly incorporating AI-driven capabilities into their operations. Since the introduction of breakthrough Generative AI models, CEOs have increasingly discussed AI and its workplace applications in their earnings calls, and companies have raced to leverage this technology.

*Note : The combined market size for generative AI foundation models, model management platforms, and services does not include the market for individual generative AI applications (such as ChatGPT).

Key adopter quote

“We’re finding tangible ways to leverage GenAI to improve the customer, member, and associate experience. We’re leveraging data and LLMs from others and building our oDoug McMillon, CEO of Walmart (during Walmart’s Q2 2025 earnings call on

The AI hardware market—specifically, data center GPUs—also experienced vast growth, climbing from $17 billion in 2022 to $125 billion in 2024 as major hyperscalers and large IT software companies (most notably, Salesforce and Meta) raced to expand their cloud and AI capabilities using the powerful processors.